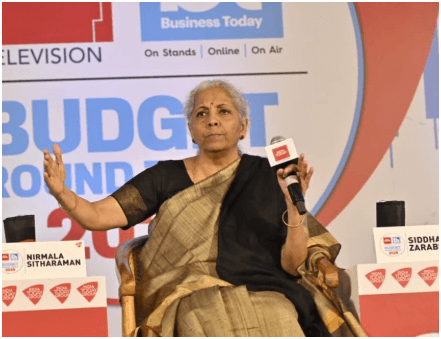

GST Reform Breakthrough: Finance Minister Nirmala Sitharaman has announced plans to reduce and rationalize Goods and Services Tax (GST) rates, following recommendations from a group of ministers working on tax system reforms.

The move aims to simplify the current tax structure and enhance compliance, addressing concerns raised by businesses and policymakers since the implementation of GST in 2017. The GST system, which replaced multiple indirect taxes, currently has multiple tax brackets that have posed challenges for businesses, leading to calls for streamlining the structure to improve ease of doing business.

The proposed changes come as part of ongoing efforts to make the tax system more efficient and business-friendly. One of the primary objectives is to reduce the number of tax slabs, which currently range from 5% to 28%, depending on the type of goods and services. The government is exploring the possibility of merging certain tax slabs to create a more uniform structure, reducing ambiguity and making compliance easier for businesses. Experts believe that a simplified tax structure could also help in curbing tax evasion and increasing overall tax collection by making the system more transparent and predictable.

Businesses, especially small and medium enterprises (SMEs), have long argued that the existing GST framework is complicated, requiring extensive paperwork and compliance efforts. Many have faced difficulties in managing input tax credits and dealing with frequent changes in tax rates and rules. By rationalizing the tax rates, the government aims to ease the burden on businesses and encourage greater participation in the formal economy. Simplified tax brackets could also reduce classification disputes, where businesses struggle to determine the appropriate tax rate for their products or services.

The decision to review and restructure GST rates is a result of extensive discussions within the GST Council, which includes representatives from both the central and state governments. The group of ministers tasked with tax reform has been analyzing the impact of various tax slabs on revenue collection, inflation, and economic growth. Their recommendations have played a crucial role in shaping the upcoming changes, which are expected to be implemented in phases to ensure a smooth transition.

Consumer impact is another key consideration in the proposed GST revisions. While businesses seek relief in compliance and tax rates, consumers also stand to benefit from potential price reductions in certain goods and services. A more streamlined tax system could lead to cost savings for businesses, which may be passed on to consumers in the form of lower prices. However, any changes in tax rates must be carefully balanced to avoid unintended consequences, such as revenue shortfalls for the government or inflationary pressures on essential goods.

Sectors such as manufacturing, retail, and services are closely watching the developments, as GST changes could significantly affect their cost structures and pricing strategies. The hospitality industry, for instance, has been advocating for lower GST rates on hotel stays and restaurant services, arguing that high tax rates impact tourism and consumer spending. Similarly, industries dealing with essential goods, such as food and healthcare, are hopeful that the tax rationalization will bring relief and promote affordability.

As the government moves forward with its plans, stakeholder consultations are expected to play a crucial role in fine-tuning the final structure. The GST Council is likely to hold further discussions with industry representatives, tax experts, and state governments to ensure that the revised tax framework aligns with economic growth objectives while maintaining fiscal stability.

Since its introduction in 2017, GST has undergone multiple revisions, with the government adjusting tax rates on various products and services based on market feedback and economic conditions. The latest round of reforms marks another step toward refining the system to make it more efficient, transparent, and business-friendly. By reducing complexity and improving compliance, the government aims to strengthen the tax ecosystem and support India’s long-term economic growth.

The final details of the proposed GST changes, including the specific rates and implementation timeline, are expected to be announced after further deliberations within the GST Council. As businesses and consumers await the revised structure, the emphasis remains on balancing revenue generation with ease of compliance and economic growth. The upcoming GST rationalization could mark a significant milestone in India’s tax reform journey, setting the stage for a more robust and predictable taxation system.

Stay informed with the latest updates – click here .